Banker to the nation

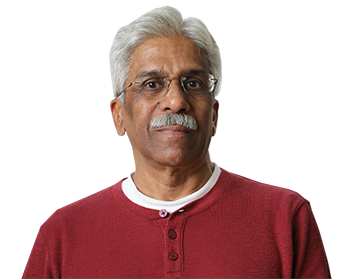

S. Venkitaramanan, an IAS officer who served as the Governor of the RBI from December 1990 to December 1992 is no more. Two events in which he had participated are worth recording. Both show him as statesman who did his best for his country, for which he deserves to be remembered.

Starting in late 1990, India faced severe balance of payments stress. This had been precipitated by a slowing of inward remittances and a rise in the price of oil due following the invasion of Kuwait by Saddam Hussain. The current account of the balance of payments was subjected to a double whammy, a reduction of receipts and a rise in the value of imports. In 1990-91 the current account deficit swelled to 3 percent of the GDP, a level highest by far in two decades. The import cover afforded by India’s reserves plummeted to a historic low of three weeks at the peak of the crisis. There was speculation that India would default on its external payments obligations. It was in that moment that the RBI led by Mr. Venkitaramanan played a sterling role, which in effect came to pledging its gold to international banks for a hard currency loan. The details of these initiatives and their significance are set out in the RBI’s official history: “In April 1991, the Government raised US$ 200.0 million from the Union Bank of Switzerland through a sale (with a repurchase option) of 20 tonnes of gold confiscated from smugglers (sic). Again, in July 1991, India shipped 47 tonnes of gold to the Bank of England to raise another US$ 405.0 million. This action helped the country repay its international donors and creditors, though it was not sufficient to completely absolve the country of the crisis.” The act of pledging the country’s gold, which involved transporting it overseas, had been mocked at by some in India. It only reveals an ignorance of the world. A country builds reserves in anticipation of using it on a rainy day. For the RBI to have used its own to stave off a default was an act of courage and imagination. Indeed it was the smartest economic management. Not only India’s prestige but also its reputation as a reliable counterparty in business had been salvaged. It only needs to be recalled that India imports around 80 percent of its oil to recognise the practical value of the manouvre. Default would have narrowed India’s access to the global loan markets to finance its imports were its export earnings to fall short in the future. With the sale and pledging of India’s gold reserves, a breathing space within the payments crisis had been created.

Prior to its efforts to raise international loans, the RBI had begun a programme of import compression, implemented mainly via raising the cash margin on imports. While this had commenced before Mr. Venkitaramanan had assumed office as Governor, it was under him that the policy assumed greater force. The cash margin was hiked four-fold between October 1990 and April 1991. Supplementary measures that raised the cost of imports were implemented too, all together constituting a stringent effort to rein them in. This strategy turned out to be a winner, and the current account deficit flipped from a high of 3 percent in 1990-91 to a mere .3 percent of GDP in 1991-92. This almost eliminated the need to raise foreign exchange to finance India’s non-debt payments. Though a government led by Narasimha Rao was to take office in mid-1991 and set in motion measures, including a devaluation of the rupee, to improve the balance of payments over the long term there is reason to believe that the immediate improvement of the balance of payments may be largely attributed to the import compression put in place by the RBI. This is implied by the data, which show that while imports contracted substantially in 1991-92 exports did not rise, in fact they declined slightly. The RBI’s official history of the period states “At a critical time and in the thick of the BoP crisis, the main task of the Reserve Bank under the leadership of the Governor, Shri S. Venkitaramanan, turned out to navigate the country through the troubled waters.” It concludes that the crisis was “successfully resolved”. However, it is the economic reforms that followed which have received far greater attention from the public at the time, and understandably. Dr. Manmohan Singh and his team had cut a dash with their bold reconfiguration of the economic policy regime. It is this that is remembered. Once the balance of payment crisis had passed, its architects came to be forgotten and their heroic guarding of India’s international prestige and financial credentials was left unsung in the public sphere. And, for Governor Venkitaramanan himself, the ending of his term was less than glorious due to what the RBI’s official history terms “issues related to an unexpected breakout of irregularities in securities transactions from April 1992”, known to the public as “the Harshad Mehta scam”. As public sector commercial banks were implicated in the development, it could not but have been seen as having taken place under the RBI’s watch.

Finally, having had the privilege of glimpsing Mr. Venkitaramanan at work, I should narrate the experience, as I believe it to be a matter of public interest. Sometime in the middle of 1991 I received a letter from him saying the RBI had noticed an article of mine on a topic related to the conduct of monetary policy, and that it would be happy to hear me in person. This demonstrated a remarkable openness, for I was not only unknown professionally but also my paper was critical of research that had emerged from the RBI. A follow up was to come soon after, when, in September of the same year I was invited, along with over 20 economists, to meet the Governor on the measures taken to deal with the balance of payments crisis. Noticeably, every shade of opinion on the Indian economy, not to mention its every geography, was represented at the table that day. But what was more impressive was that the Governor responded to each presentation made, these having ranged from some arcane aspect of macroeconomic theory to the participant observation by one of his colleagues on the black market for the rupee in Dubai! The atmosphere created was one of frank exchange of views, absence of hierarchy and a non-partisan focus on India’s national interest. What was on display would have led anyone to imagine that they were witnessing Camelot on the Arabian Sea, or, if you prefer that metaphors remain Indian, what Bharat was really meant to be. So, I was not surprised when later I heard those privy to the IMF’s negotiations with the RBI say that Mr. Venkitaramanan would be quick to parry their arguments with research produced by economists based in India. Probably, it was this belief that a country must rely on its own intellectual resources that led him to establish the Development Research Group within the RBI. It was meant as a vehicle to take independent economists to India’s central bank, so that there would be professional interaction between its staffers and stakeholders outside. In this, though, he may not have fully succeeded. Today, the RBI’s highly visible struggle to control inflation reveals that it is perhaps more eager to be seen to adhere to the current orthodoxy in economics than to understand how India’s economy works.